how much does cash app charge to deposit

Cash App isnt an expensive or bank-breaking platform. Select a deposit speed.

How To Direct Deposit On Cash App Step By Step

As it turns out Cash App does not charge any fees for mobile check deposits.

. You can deposit up to 3500 per check and up to 5 checks totaling 7500 per month. Typically Cash App ATM withdrawals charge 2. With Paper Money deposits you can deposit up to 1000 per rolling 7 days and 4000 per rolling 30 days.

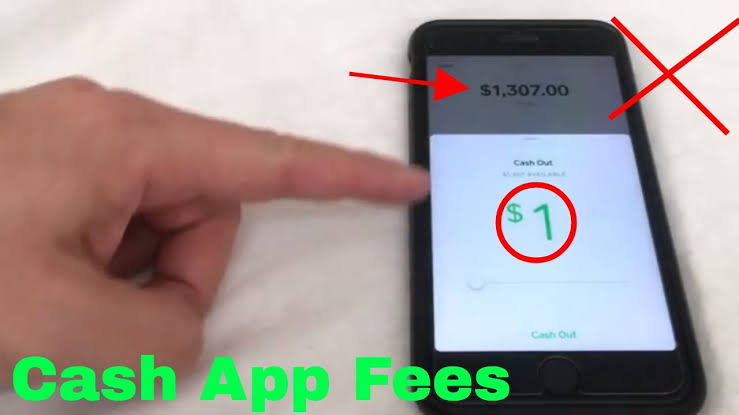

To cash out funds from your Cash App to your bank account. If so the fee will be listed on the trade confirmation before you complete the transaction. A 3 percent fee on a 50 purchase translates to a 15 transaction fee.

Confirm with your PIN or Touch ID. How Much Does Cash App Charge for 1000 Instant Deposit. So sending someone 100 will actually cost you 103.

Cash App has some limits for depositing checks. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. If you run into a deposit limit well send you a notification with more information.

This fee goes towards processing the transactions and paying out your funds. Use Touch ID or enter your PIN to confirm. In cash app instant deposits cost 15 of the total amount.

Cash App makes direct deposits available as soon as they are received up to two days earlier than many banks. The 7-day and 30-day limits are based on a rolling time frame. Cash App Support Direct Deposit.

Cash App Support Bitcoin Fees. Cash App Direct Deposit Fees are 025 per transaction. The additional fee is always something users would love to go around therefore many of you must be wondering if the cash-out can be made completely free.

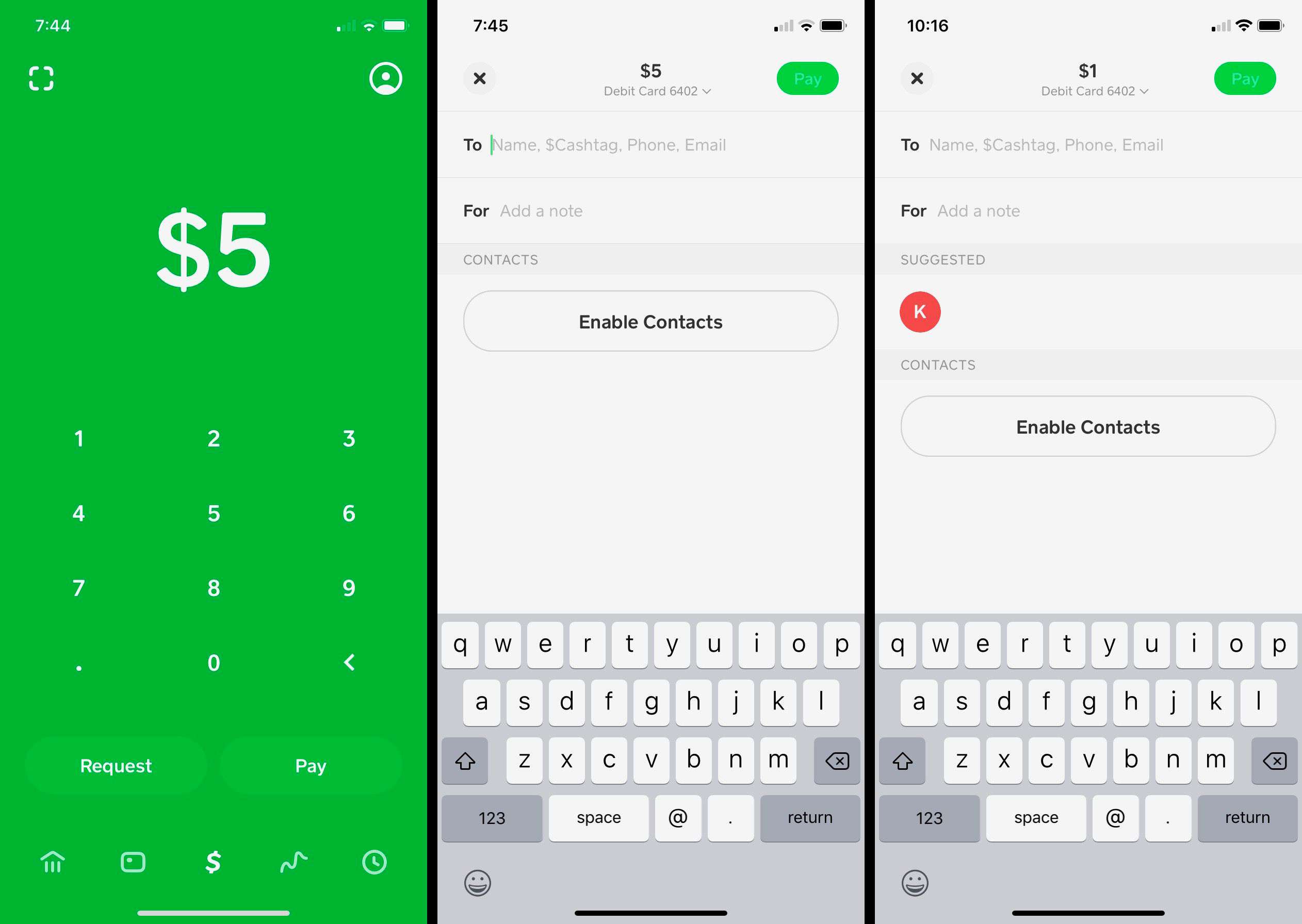

Cash App charges a 3 percent fee if you use a credit card to send money but making payments with a. Deposit paychecks tax returns and more to your Cash App balance using your account and routing number. Cash App charges a 3 on money transfer via credit card 15 of the total amount on instant funds transfer 2 to 3 fee on cryptocurrency and 2 on per ATM withdrawal.

Tap the BankingMoney tab on your Cash App home screen. Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card. 15 50 5150.

The cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. How much does cash app take out of 800. What is the Cash App Fee for 20.

If you run into a deposit limit well send you a notification with more information. When you buy or sell bitcoin using Cash App the price is derived from the quoted mid-market price inclusive of a margin or spread. You will be assessed a 50 fee with the credit card or 3 percent of the purchase.

How to Re-Open a Closed Cash App Account. You can use Walmart to deposit into Cash App and add anywhere from 20 to 1100 at one time. Standard deposits are free and arrive within 1-3 business days.

You can receive up to 25000 per direct deposit and up to 50000 in a 24-hour period. What is the cost of a 50 immediate deposit with Cash App. Instant Deposits are subject to a 15 fee but arrive on your debit card instantly.

The 7-day and 30-day limits are based on a rolling time frame. Cash Cards work at any ATM with a fee ranging from 2-250 charged by Cash App. How much is Cash App fee.

Please see the steps below. For an instant deposit of 1000 to a personal Cash App account you will be charged 15 and receive 985. Cash App Support Cash Out Instructions.

Are There Limits for Depositing Checks with Cash App. Your debit card will be credited with the money immediately if you opt for the instant deposit option which costs 15 percent minimum of 25 cents. How Much are Cash App Direct Deposit Fees.

With Paper Money deposits you can deposit up to 1000 per rolling 7 days and 4000 per rolling 30 days. Choose an amount and press Cash Out. The fee may be higher if you use ATMs other than your own network.

Tap the Balance tab on your Cash App home screen. Transactions must be a minimum of 5 and cannot exceed 500 per deposit. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total.

If You Are Sending Money Via A Credit Card Linked To Your Cash App A 3 Fee Will Be Added To The Total. Most ATMs will charge an additional fee for using a card that belongs to a different bank. Instant Deposits include a 05 percent -175 percent charge with a minimum cost of 025 and are immediately credited to your debit card.

You will ultimately pay. However this applies to other payment apps as well and not simply Cash App as a regular cost. Instead most of its services are free of cost instead of a couple in which you are liable to pay the associated fee.

Cash app charges 15 minimum 025 for each instant deposit. Transactions must be a minimum of 5 and cannot exceed 500 per deposit. Standard deposits are free and arrive within 1-3 business days.

If you receive money on Cash App and want to cash it out immediately youll pay a 15 fee for an instant deposit. One wat to add cash to your Cash App balance is to do a direct deposit. Once you have received qualifying direct deposits totaling 300 or more Cash App will reimburse fees for 3 ATM withdrawals per 31 days and up to 7 in fees per withdrawal.

Cash App may charge a small fee when you buy or sell bitcoin. Instead you may obtain a Cash Card and use your Cash App balance without having to transfer funds from your bank or debit card. If you use a credit card to send money through Cash App youll pay a 3 fee which is 3 for a 100 transaction.

You can make use of free ATM withdrawal if you have got 300 deposited in your Cash App.

Cash App Cash App Verification Failed App Fails Cash

What Does Pending Mean On Cash App Learn All About The Cash App Pending Status Here

Cash App Down Current Problems And Outages Downdetector

How To Send Money On Cash App Without Debit Card Techyloud

How To Add Bank Account To Cash App 2022 Link A Bank Account Now

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method

How To Get Free Money On Cash App Gobankingrates

How To Transfer Money From Your Cash App To Your Bank Account Gobankingrates

What Is The Cash App And How Do I Use It

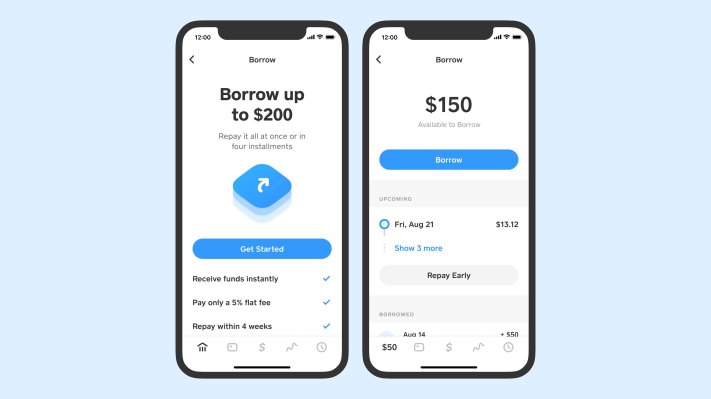

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Cash App Vs Venmo How They Compare Gobankingrates

Cash App Routing Number What It Is And Where To Find It Gobankingrates

/A2-DeleteCashAppAccount-annotated-5d48188372ff4dcb945d9c30f361bc4b.jpg)

How To Delete A Cash App Account

What Does Cash App Transfer Failed Mean To Us App Support How To Get Money Coding